Vehicle programs. Whether you’re in the pizza business, the healthcare space, construction, any of the numerous business services markets or some other industry, chances are you have one. Vehicle programs, also referred to as business vehicle programs or vehicle reimbursement programs, are a part of business operations. They’re often so much a part of what your company does, it’s hard to imagine there are types outside of the one you’re currently using. It’s even harder to imagine that your company might be using the wrong one. So what goes into a vehicle program? And what makes a vehicle program right for your company?

What is a vehicle program?

A vehicle program is how your company provides, or reimburses, its employees’ business miles driven. That travel could be anything from a sales rep driving to meet prospects or waste management teams collecting garbage across the city. There are different needs for vehicle programs, so there are many different types to consider which we will cover below.

The Types of Vehicle Programs

Vehicle programs have developed from the various ways companies need driving employees. A sales representative driving for an enterprise company across a vast territory is unlikely to operate with the same vehicle program as a traveling nurse working for a clinic in a smaller community. Therefore, different vehicle programs have developed to meet the needs of the company.

The top five vehicle reimbursement programs are:

- Fleet or company provided vehicles: A fleet vehicle program is when a company provides its employees with a car for business purposes

- Car allowance: A car allowance, also known as flat allowance, program provides employees with a flat compensation every month to cover driving expenses.

- Cents-per-mile or mileage reimbursement: Companies with cents-per-mile (CPM) programs – or mileage reimbursements – have employees report their business mileage and reimburse them a set rate per mile

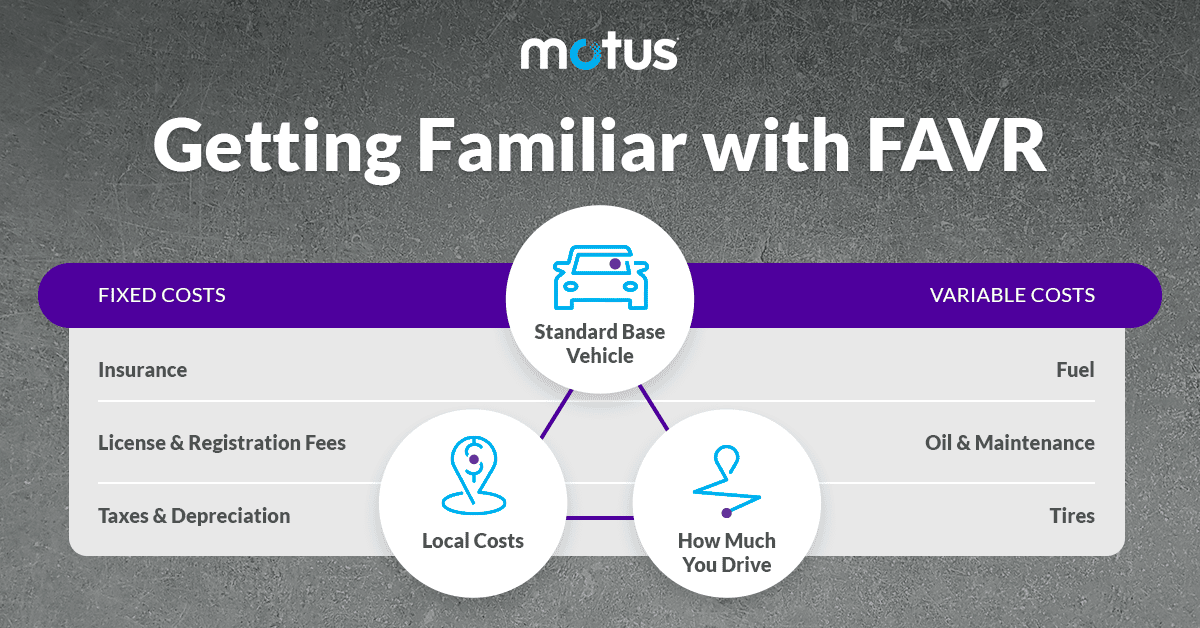

- Fixed and variable rate reimbursement: Fixed and Variable Rate (FAVR) programs reimburse employees for their individual fixed and variable driving costs, scaling according to the amount of mileage people drive.

- Hybrid vehicle program: Companies may use two or more programs to meet the needs of the company.

The Goal of a Vehicle Program

Vehicle programs exist to support the efforts of the company. That may be providing the company’s product through service operation or growing the business through sales. Just as companies are supported by the employees driving for work, they must support those same driving employees. Vehicle programs also exist to see that these employees receive appropriate reimbursement.

How Business Vehicle Programs Work

When a company implements a business vehicle program, they do so to ensure their employees are equipped to perform their role with the company. For some companies, that’s providing leased or outright purchased fleet vehicles. For other companies, that’s setting up methods to expense business driving mileage. Driving employees use their own vehicles or company provided ones, for business purposes and often personal reasons as well. Below are the more in-depth summaries of the most popular business vehicle programs.

Fleet or Company-Provided Vehicles

Fleet programs are one of the more popular company car programs. They’re also the most expensive. The average annual cost of a mid-size SUV fleet vehicle per employee is $12,385. That’s nearly $4,000 more than other vehicle program alternatives. And that figure doesn’t take into account the constant exposure to liability.

Why are fleet vehicles an expensive vehicle program? One of the highest expenses of fleet vehicles is the vehicles themselves. Leasing or outright owning them are both expensive options. But your company is also paying for routine maintenance, vehicle repair and fuel costs. Say a driving employee leaves the company. The company still has to make lease, interest and licensing payments. Idle vehicles cost companies an average of $648 per month.

There are some industries that require utility vehicles that employees would have a tough time securing outside of the job. Garbage trucks, powerline trucks and tree trimmers to name a few. But not every company needs to provide their employees with a vehicle, no matter how much of a perk they think it might be.

Vehicle Allowance or Car Allowance

Car allowance vehicle programs are popular because they’re easy to set up and manage. No matter how much or how little your employee drives, you give them a few hundred dollars a month. But what makes it the easiest option also makes it a bad one.

Most companies don’t realize the tax implications that come with a vehicle allowance program. For example, the average car allowance in 2021 was $575. However, because a car allowance isn’t attributed to mileage, it’s taxed as additional income. Employees only see $393. Due to payroll tax, car allowances also cost employers more.

Beyond being a taxable payment, car allowances don’t always cover the costs of driving personal vehicles for business. Employees receiving an allowance will not be compensated if they drive beyond the miles the stipend covers. This incentivizes them to drive less. While an accountable allowance can substantiate mileage, it does little to make the reimbursement more fair or accurate.

Cents-per-mile or Mileage Reimbursement

Most companies use the standard IRS mileage rate as their reimbursement rate for employees. It’s rather easy to implement and, if carried out correctly, it can be tax free.

The difficulties with this vehicle program lie in two main areas. The first is proper mileage tracking. Employees are required to log a few essential pieces of information before and after each business trip. That doesn’t always happen, or at least not correctly. Mileage fraud can be a large issue.

The second is equity. Employees across the company receiving the same cent-per-mile rate may seem fair, but gas prices, insurance and other driving costs vary. That variation isn’t just state to state, but within each state too. A driving employee in California might pay $4.68 for gas while another driving employee in Mississippi pays $3.12. To provide both with the same rate is far from fair.

This doesn’t mean the cents-per-mile program is a bad program. In fact, it’s ideal for companies with employees that drive less than 5,000 miles each year in the same general region. Add an automated mileage capture app to reduce mileage fraud issues and you’re in business! If your mobile workforce is higher mileage or more widespread, you may want to look elsewhere.

Fixed and Variable Rate Reimbursement

A FAVR program accounts for the geographic cost differences for each employee’s location. This program has no tax waste and accurately reflects each individual’s business mileage. When properly administered, FAVR programs are tax-free, benefiting employers and employees. What’s more, FAVR is the only reimbursement method recommended by the IRS.

The right Fixed and Variable Rate program looks at both fixed and variable costs of owning and operating a vehicle. Fixed costs don’t see much fluctuation and include expenses like insurance payments and license and registration fees. Variable costs change rapidly and include expenses like tires, maintenance and fuel. Companies providing a FAVR reimbursement to employees ensure they receive fair and accurate payments. A proper reimbursement may be viewed as a recruiting and retention benefit, especially during periods of high gas prices.

Hybrid Vehicle Program

Much like the various industries in need of vehicle programs, companies often need different vehicle programs for different employees. It is not unusual for employers to use more than one vehicle program. For example, they may offer a mileage reimbursement program for employees that don’t drive over 500 miles each month and a FAVR program for those that do. This is especially true of employers that are larger and have more employees and various locations.

| Vehicle Program | Scalable | Accurate, Localized Reimbursement | IRS Compliant | Taxable |

| Car Allowance | No | No | No | Yes |

| Company Provided | No | No | Depends | Yes |

| Mileage Reimbursement | No | No | Depends | Depends |

| Fixed and Variable Rate | Yes | Yes | Yes | No |

How do I choose a vehicle program for my company?

The vehicle program(s) your company decides on depends on the size and needs of your company. To help think through which factors matter most to your business, we’ve developed this series of questions. Answering them will help you to make the right decision, knowing it will work for your employees and your business. To select the most efficient vehicle program for your business, you’ll need to answer the following:

1. Do you have the capital to purchase or lease vehicles for your mobile workforce?

If the answer is yes, you can afford to administer company-owned vehicles to all of your mobile employees, then a fleet program is a viable option. If the answer is no, perhaps because you’re running a small business with limited capital or your mobile workforce is too large to support, a reimbursement program would be the better option. In this case, a tax-free Fixed and Variable Rate (FAVR) program can help you to ensure cost efficiency.

2. Can your business assume the risk for vehicle liabilities?

If your business can assume the risk for any potential accident at any time (beyond standard business hours), a fleet program would be an available option. If your business wouldn’t be able to take this risk, a reimbursement program would allow you to avoid total liability. Instead, your company would only assume this risk with vehicles employees drive for business purposes.

3. Do you have the administrative resources available to support your program?

If you have the resources to manage corporate vehicles, a fleet program would still be suitable. If your business doesn’t have the overhead for managing this, consider a reimbursement program with automated mileage capture systems that include a simplified submission and payment processes.

4. Does your company require specialty vehicles?

If your company requires the use of a particular sized truck, to deliver product or inventory for example, you’ll want a fleet program. For these business types, purchasing specialty vehicles will ensure requirements are met. A fleet program will also give you the ability to incorporate your branding onto the vehicle. If your company doesn’t have these requirements, a reimbursement program where an employee can choose to drive any type, make or model vehicle provides flexibility to the employee.

5. Are your mobile employees on the road every day?

If your employees drive more than 5,000 business miles per year, your company can best support them with a fleet or FAVR reimbursement program. Say your employees don’t require a vehicle every day? Think about implementing a cents-per-mile reimbursement program where employees can get paid tax-free.

6. How sizable is your mobile workforce?

If your current mobile headcount is high, you can create efficiencies by having a fleet program. That being said, if you have a smaller mobile workforce, a reimbursement program will be more cost-effective for your business. A FAVR program is also a potential option, but keep in mind that they require you have at least five employees for you to qualify for tax-free reimbursements.

Consequences of Choosing the Wrong Vehicle Program Vendor

Choosing the wrong vehicle program vendor can have significant consequences for a company. It’s important to thoroughly research and evaluate all options to avoid making a mistake. Here are some potential issues that can arise when selecting the wrong vendor:.

- Price: Opting for a vendor based solely on a lower price can lead to additional fees and hidden costs, resulting in unexpected expenses.

- Implementation: Inadequate support and lack of clear processes during implementation can result in a rocky start for the vehicle program, causing confusion and frustration among administrators and driving employees.

- Administrative Burden: Choosing a vendor with limited capabilities can increase the administrative workload for the company, leading to inefficiencies and distractions from core tasks.

- Reliable Mileage Capture: A wrong vendor may provide an unreliable mileage capture app, leading to inaccurate mileage records and non-compliant reimbursement processes.

- Reimbursement Processing: Inefficient reimbursement processing by the vendor can cause delayed or incorrect payments, resulting in frustrations for driving employees and potential higher turnover rates.

- IRS and Labor Law Compliance: A vendor lacking proper compliance measures may expose the company to legal risks, non-compliant mileage logs, and inaccurate reimbursements.

- Onboarding and Off-boarding Challenges: Inefficient processes for adding or removing drivers can create additional administrative burdens and complexities for the company.

- Product Expansion: Choosing a vendor with limited capabilities may restrict the company’s ability to expand its vehicle program or support additional vehicle reimbursement needs.

Selecting the Right Vehicle Program Vendor

We’ve walked through the red flags and what makes a bad vehicle program vendor. But what makes a good vehicle program vendor? What should you be looking for? To avoid the above issues, it’s crucial to choose the right vehicle program vendor. Here are some factors to consider when evaluating potential vendors:

- Expertise: Look for a vendor with expertise in calculating appropriate reimbursement rates and selecting the best program for your business. They should have a deep understanding of IRS compliance and industry-specific needs.

- Ease of Implementation: Choose a vendor that offers an easy implementation process and provides training on the associated technology. They should support a smooth transition and minimize disruption to your operations.

- All-In-One Platform: Opt for a vendor that offers an all-in-one platform to manage multiple vehicle programs, providing comprehensive insights and reporting capabilities.

- Scalability: Ensure that the vendor’s solutions can scale with your company, allowing for rapid expansion or downsizing as needed. They should be flexible and adaptable to changing market conditions.

- Customer Satisfaction: Research customer feedback and reviews to gauge the vendor’s performance and customer satisfaction levels. Look for references from companies in your industry and of similar size.

Getting Started with a Vehicle Reimbursement Program

Once you’ve answered the above questions and found what you need from your vehicle program, it’s time to put the foot on the gas. You can set up a vehicle program policy in house, but that may create more of a mess than its meant to fix. Outsourcing your vehicle program can still save you money and lift the administrative burden of rolling one out internally.

At the end of the day, the right vendor solves the pain points in your vehicle program without creating additional ones. The ideal vendor comes with years of expertise providing solutions to satisfied customers of all sizes and from all industries. They should also have a robust platform for both accurate calculation and reimbursement processing. Implementation should be easy and the program should be created to scale with the climate of the economy.

Transform Your Vehicle Program with Motus

If you’ve made it this far, you know we’re in the vehicle program business. With over 40 years of experience under our belt, we’ve helped hundreds of companies across various industries transition from their previous vehicle program to what they’re currently operating. Our platform provides comprehensive data to ensure employees receive fair and accurate reimbursements while companies control costs and remove administrative burden. If you’re still looking into vehicle programs, you can learn more about our vehicle reimbursement program options in our guide: Business Vehicle Programs 101.

If you’re looking to take the next step, you can contact us to set up a meeting and walk through how our solutions can meet your needs.