Running a mileage reimbursement, or cents-per-mile (CPM), program without a properly-calculated mileage reimbursement rate can result in many challenges. Using a rate that suits their driving employees will help navigate…

Read more

“How much should I be reimbursed for mileage?” Ever ask yourself that question? If the answer is yes, you’re not alone. Companies typically reimburse employees that drive their personal vehicles…

Read more

Mileage reimbursement programs are essential for businesses whose employees use their own vehicles. But implementing the best, most cost-effective program for your company isn’t necessarily simple. Programs that reimburse employees…

Read more

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices BOSTON, Mass., December 22, 2020 – The Internal Revenue Service (IRS) today announced…

Read more

Is your company’s mileage reimbursement rate the best for your drivers? Mobile workers are an integral part of any company’s business. Whether they’re made up of sales reps, managers, consultants,…

Read more

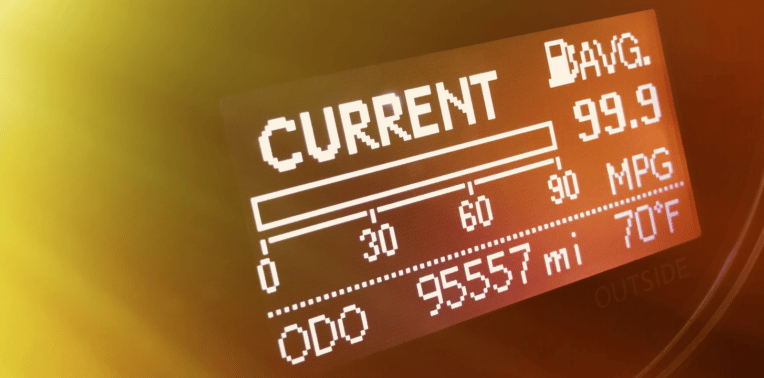

Let’s set the record straight: no, the IRS mileage rate is not a required mileage reimbursement rate. Set by the IRS, the standard business mileage rate serves as a “safe…

Read more

So you’ve decided to reimburse your employees for driving their personal vehicles for work. Problem solved, right? Not so fast. Vehicle reimbursement has many advantages, but those benefits can be…

Read more