It’s no secret that the old-school company car is falling out of favor with many driving employees. While once viewed as a must-have, the perceived ‘perk’ of a traditional fleet car has lost its shine according to 60 percent of employee drivers polled by Motus in 2024.

While driving employees crave more choice, taking on the buying or leasing—as well as long-term storage, maintenance and fuel costs—of their own vehicle can feel like a burden if employees have to do it alone.

This is especially true when they’re faced with the dilemma of buying or leasing a vehicle for work. While the beauty of reimbursement programs like the IRS-approved Fixed and Variable Rate (FAVR) model is that it considers unique costs of ownership and upkeep to ensure fair, accurate and tax-free compensation, it also puts the onus on drivers to make some highly consequential decisions.

Take, for instance, the choice between buying versus leasing. There are benefits to employee drivers in both scenarios that jump out from the start—for instance, buying a car means you own it for the long haul, whereas leasing may result in smaller monthly payments. In the context of employee driving, however, there is a lot more that needs to go into calculating this decision to ensure that your reimbursement program will benefit you fairly on and off the clock.

Fortunately, driving employees don’t need to make this decision alone. To help shed some light on the main considerations, potential pitfalls, and common scenarios that impact this big decision, we’ve pulled together this 101 guide on buying versus leasing.

Buying vs. Leasing: A Primer

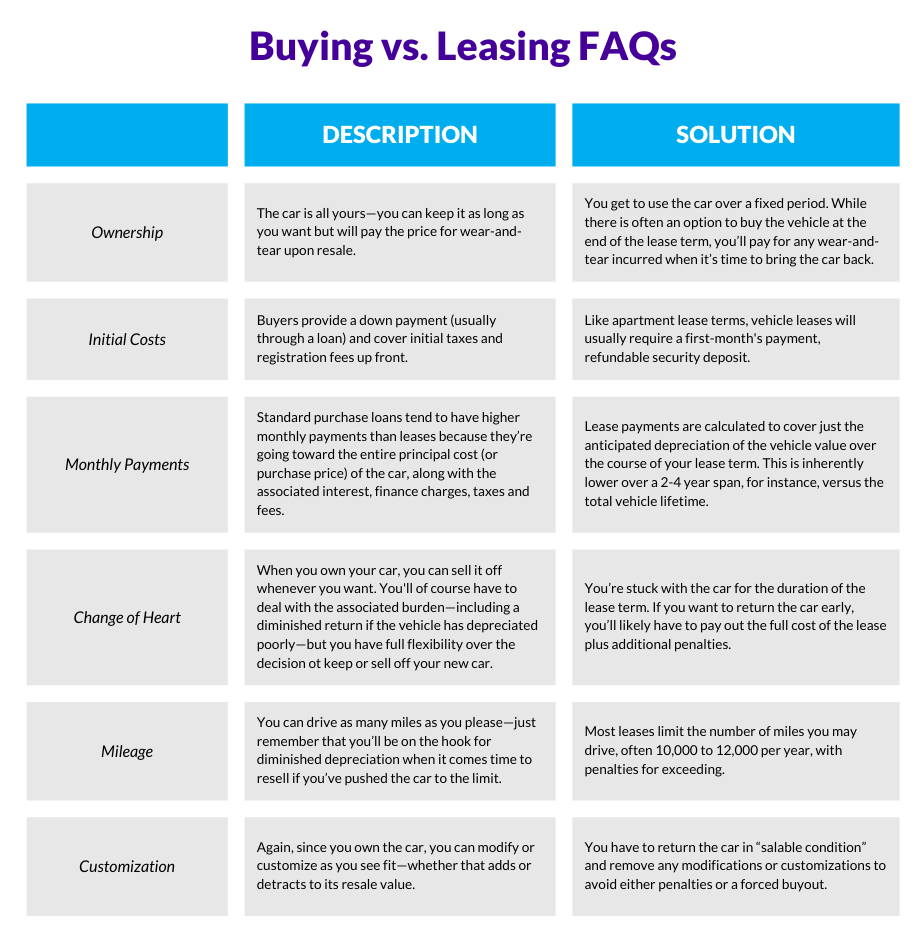

To set the scene, let’s lay out some of the table stakes of what a buying agreement will grant you compared to leasing.

The fundamental distinction is that buying allows you to own the vehicle as your own asset to treat as you like, keep for as long as it suits you, and recoup a share of your investment upon resale (much more on that later).

Leasing is akin to ‘renting’ a vehicle; agreements dictate either a set term and/or mileage travel threshold, and lessees make monthly payments until that threshold is met, before handing the vehicle back over to the dealer.

‘Doing the math’ around the lease terms is a critical consideration for employee drivers in this scenario. For instance, a sample Kia lease ranges from 24 to 48 months, while also specifying a mileage limit of 10,000 to 15,000 miles per year. If your driving habits have you on the road for more than 15,000 miles annually, this leasing scenario is already not a good fit, as you may incur financial penalties for exceeding your limit or even must return the car earlier than anticipated.

That said, the monthly payments for leases tend to be much cheaper than purchases, as drivers aren’t paying toward the ‘principal costs’ (Total lifetime) of the vehicle as an asset-to-own. Instead, leasing allows you to just borrow and repay the difference between the car’s value as a new model and the anticipated residual value at the end of the lease term. As a result, some lessees will choose a luxury or premium model that they might not be able to afford buying outright.

But when you dig deeper into the pros and cons, the short-term benefits of leasing don’t always outweigh the long-term costs or headaches.

Leasing 101: The Pros

Before we get too deep into the cautionary tale of leasing, it’s important to understand the many benefits that might make leasing a better option depending on your role. If you’re looking for comfort, or selling ‘prestige’, for instance, leasing a premium model for your day-to-day work travel could be attractive. Regardless of your title or duties, here are some of the key benefits that drive folks to pursue leases.

- You’ll have access to a new car fresh out of the factory, meaning (ideally) minimal operational or maintenance issues during the term of your lease.

- Because these cars are generally the latest models, you can usually enjoy a manufacturer’s new-car warranty.

- Along with the latest active safety features, many lease terms includes the costs of scheduled maintenance.

- When you’re done with the car, you simply must return it to the dealer—no need to have to worry about the fluctuations in the cars resale value or the hassle of selling the car in the first place.

Leasing 101: The Cons

For all these benefits, there are many scenarios where the ‘math’ on leasing doesn’t add up for personal or professional driving.

- While lease terms aren’t for the entire lifetime of a vehicle, many drivers will find themselves in a cycle of leasing new models over consecutive terms that costs significantly more than a loan-to-buy. That’s because drivers are paying lease fees for a car during the period where its value is depreciating most rapidly (see our recent blog for more details on the importance of resale value).

- Lease contracts specify a limited number of miles. Unfortunately, going over incurs an excess mileage penalty that can range from 10 cents to 50 cents for every additional mile. To that end, drivers don’t get credit for unused miles, making it important that potential lessees have a clear vision of how much they plan to drive with a focus on mileage terms over the time of lease.

- Dealers also want their leased vehicles returned in good condition. Just like renting an apartment, if you’ve incurred excessive wear-and-tear—whether from rowdy child passengers, teen drivers, or even just minor fender benders—the penalties will add up.

- Should you want out of your lease agreement early, there are yet more penalties that you have to brace for. Worst of all, they’ll all be due at once, and often equal the amount of the full lease term.

Leases vs. Long-term loans

There are additional nuances between leasing and taking out a loan to purchase a vehicle that are worth emphasizing.

Again, the primary distinction is that purchasing gives you full ownership, so that when the terms of your purchase agreement are met—for instance, a six-year loan is finally covered—a driver won’t have to turn in that vehicle at any point. Not only does this allow drivers to keep a beloved model for as long as they want as opposed to returning it after a relatively short 2–4-year lease period, but they can “ride out” depreciation, reselling the car only once the resale value has offered a solid ROI.

To put a finer point on it, here are the key differentiators between Buying and Leasing for most drivers:

Enabling personal choice for every driver

At the end of the day, choosing whether to buy or lease ultimately comes down to how much time you plan to spend behind the wheel—both for work and for personal use. Some roles will far exceed the mileage thresholds dictated by traditional leases, for instance, while others may drive significantly less than anticipated, and have to turn in their leased car before they feel they’ve gotten their money’s worth.

This puts the pressure on businesses to ensure they’re exploring every option when mapping out vehicle programs for their driving workforce. Unlike old-school fleets, businesses don’t need to subscribe to a single vehicle program for every driver.

To learn more about building a vehicle program that’s dynamic enough to serve all your driving employees, check out our Total Costs of Vehicle Programs guide.

If you’re in the market for a new car for work or personal use, check out the Motus Blog for more resources to inform your decision.

FAQ: Buying vs. Leasing: Making the Right Vehicle Choice for Work and Personal Use

Why are traditional company cars becoming less popular among employees?

According to recent data, the traditional company car is losing its appeal, with at least 60% of employee drivers surveyed by Motus in 2024 preferring alternatives. While company cars were once considered a valuable perk, many employees now desire more flexibility and personal choice in their work vehicles. However, employees often need guidance when transitioning to personal vehicle ownership, particularly when deciding between buying or leasing. This is where reimbursement programs like the IRS-approved Fixed and Variable Rate (FAVR) model become valuable, as they account for the unique costs of vehicle ownership or upkeep and provide fair, accurate, and tax-free compensation.

What are the fundamental differences between buying and leasing a vehicle for work?

The primary distinction is ownership versus temporary use. When buying a vehicle, you own it outright as an asset that you can keep for as long as desired and potentially recoup some investment upon resale. Leasing is essentially “renting” a vehicle for a predetermined period with specific mileage limitations. Buying typically involves higher monthly payments that go toward the entire cost of the vehicle plus interest, while lease payments cover only the anticipated depreciation during the lease term. Ownership grants complete flexibility regarding mileage, customization, and selling options, whereas leases impose restrictions in these areas with potential penalties for exceeding limits or early termination.

What are the advantages of leasing a vehicle for work purposes?

Leasing offers several compelling benefits for business drivers:

- Access to new vehicles with minimal maintenance issues and the latest technology

- Coverage under manufacturer warranties and often included scheduled maintenance

- Lower monthly payments compared to purchase loans

- Opportunity to drive premium or luxury models that might be unaffordable to purchase

- Simplicity at the end of term—just return the vehicle with no concerns about resale value

- Regular vehicle upgrades every few years without the hassle of selling

These advantages make leasing particularly attractive for professionals who value image and want to minimize short-term costs and maintenance concerns.

What potential drawbacks should employees consider before leasing a vehicle for work?

Despite the advantages, leasing comes with significant limitations:

- Mileage restrictions typically range from 10,000 to 15,000 miles annually, with penalties of 10-50 cents per mile for exceeding limits

- No credit for unused miles, making accurate mileage estimation crucial

- Penalties for excessive wear and tear beyond “normal use”

- Early termination fees that often equal the remaining lease payments

- Higher long-term costs compared to buying, as lessees pay during the period of steepest depreciation

- No asset ownership or equity building

- Continuous payment cycle if repeatedly leasing vehicles

These factors make leasing potentially problematic for high-mileage business drivers or those whose work conditions might cause above-average vehicle wear.

How can businesses create vehicle programs that meet diverse employee needs?

Modern businesses should recognize that one-size-fits-all vehicle programs no longer meet the diverse needs of their workforce. Instead of traditional fleet programs, companies can implement flexible vehicle reimbursement solutions that accommodate both buyers and lessees. The IRS-approved Fixed and Variable Rate (FAVR) reimbursement model provides fair compensation based on each employee’s actual vehicle costs, regardless of whether they choose to buy or lease. This approach allows employees to select vehicles that best fit their professional and personal needs while ensuring accurate, tax-free reimbursements. For more comprehensive guidance, businesses can explore resources like the Motus “Total Costs of Vehicle Programs” guide or consult with vehicle program specialists to develop customized solutions for their driving workforce.